Mohammad Nurul Alam

Bangladesh has registered significant growth in the garment export to Middle East countries other than its traditional market, EU and USA. Because, as the second largest manufacturers the country is now receiving a lot of queries from the buyers of the Middle Eastern countries. It is now going to be major nontraditional export destination for the country. The apparel export growth to Saudi Arabia, Qatar and the UAE in the last few years are showing its successful diversification to the new destination.

The last three years Bangladesh’s apparel shipment to the western Asian nation posted a consistent growth. The amount increased from $168 million in 2020 to $246 million in 2021 and finally hit $311 million in 2022. The highest growth to Turkey recorded as 118% last year and expected to grow in next coming years. In the present analysis Middle East markets will be taken for an observation from the manufacturer’s thought.

Export to Saudi Arabia

Bangladesh exported to Saudi Arabia $89 million worth of garments in 2020, which reached $145 million in 2021 and $174 million last year. Garment exports to the second-largest country in the Arab world posted a 63% year-on-year growth in 2021 and another 20 % growth in 2022. Saudi Arabia’s world wild imports stood at $152.34 billion in 2021.

Saudi Arabia imported $ 3.90 Billion worth of apparel from the world and both the cotton and non-cotton items are almost 50% each from 100. The share of cotton items exported to Bangladesh is 65.73% and 34.27% as non-cotton apparel in 2021.

Industry insiders believe as a nontraditional apparel market Saudi Arabia can be an alternative garment export destination for Bangladesh because people from different parts of the world go there to earn and perform religious tasks.

Commerce Minister Tipu Munshi said in an inauguration of a three-day expo – “Although Saudi Arabia has over 3 crore people, their purchasing power is very high, which is why we believe our export to the country can be equivalent to that of countries having 10 crore consumers,”

“We still export little to the Saudi market, but we are hopeful that we will be able to have a bigger slice here as we are capable of producing quality products at competitive prices,” he added.

BGMEA Vice-President Shahidullah Azim said “The country mostly sources its apparel items from China, India, Turkey and other countries. Our export is still nominal despite being the second-largest apparel exporter globally, a huge opportunity in this market is still untapped owing to a lack of government initiative for long.”

Export to Kuwait market

The apparel goods sent to Kuwait may be small compared with the top three destinations namely Saudi Arabia, UAE and Qatar but it has shown the second-highest year-on-year export growth of 101 % last year.

Kuwait as a country in the middle east reported $6 million worth of garment products in 2020. This is noted to have doubled to $11.7 million the next year and hit $24 million in 2022. Apparel shipment to Kuwait has nearly doubled each year since 2020.

Rashed Mosharaff, executive director of marketing at Zaber and Zubair Fabrics Ltd (Home), said they are doing business in Saudi Arabia and other Gulf countries through their own retailers.

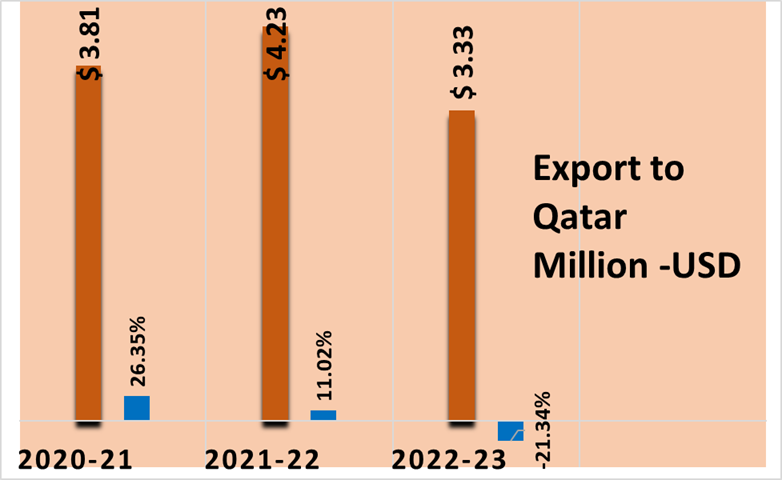

Export to Qatar

Bangladesh’s RMG export to Qatar jumped 47 % last year compared to that of 2020. Apparel shipment to the country rose 61 per cent year-on-year to $4.35 million in 2021.

Share of Qatar’s cotton and non-cotton clothing from Bangladesh respectively 38.66% and 61.34%.

Export to UAE

Bangladesh’s apparel exports to the UAE in the first quarter of FY24 also exhibited significant growth, rising by 44.18% to $90.55 million, in contrast to the $62.80 million seen in the same period of FY23.

Landmark Group, one of the largest retailers based in Dubai, is also doing well in these markets, he said, adding that Zaber and Zubair make home textiles for that retailer under their brands – Max, Homecenter, Babyshop, and Home Box.

Eleash Mridha, managing director at Pran Group, the largest agro-based products exporter, said, “We are having a good business in gulf countries, mostly in KSA, UAE, Qatar and Lebanon.”

Abdullah Almamun, Director, Abed Textile,Vice President BTMA said “The present world-wide trade situation is reminding us for diversification of product and market. We have to identify and make unique product of various culture and traditional clothes. Because recently in a seminar at Calcutta one delegation of Bhutan asked me if we could make traditional clothing that wear people at Bhutan. I think the query is a big call for us to explore new market for traditional clothing for Middle East, North Africa or South Africa.”

To grab the Middle Eastern Markets Bangladeshi manufacturers has to take the present challenges as the top of the priorities to eliminate them by government’s involvement through bilateral agreement and relationship opined industrial insiders.

Apart from European and North American region Bangladesh has been trying to expand its market globally for its garment export so the roadmap of the BGMEA for the next fifteen years is to focus on Middle Eastern and other potential Asian market rather to excessive dependence on traditional market.

The BGMEA and Bangladesh Apparel Expo are jointly organizing the weeklong events to showcase the strength of the country’s textile and garment sectors every year.